by Viktoriya Khusit | Nov 15, 2016 | Blog |

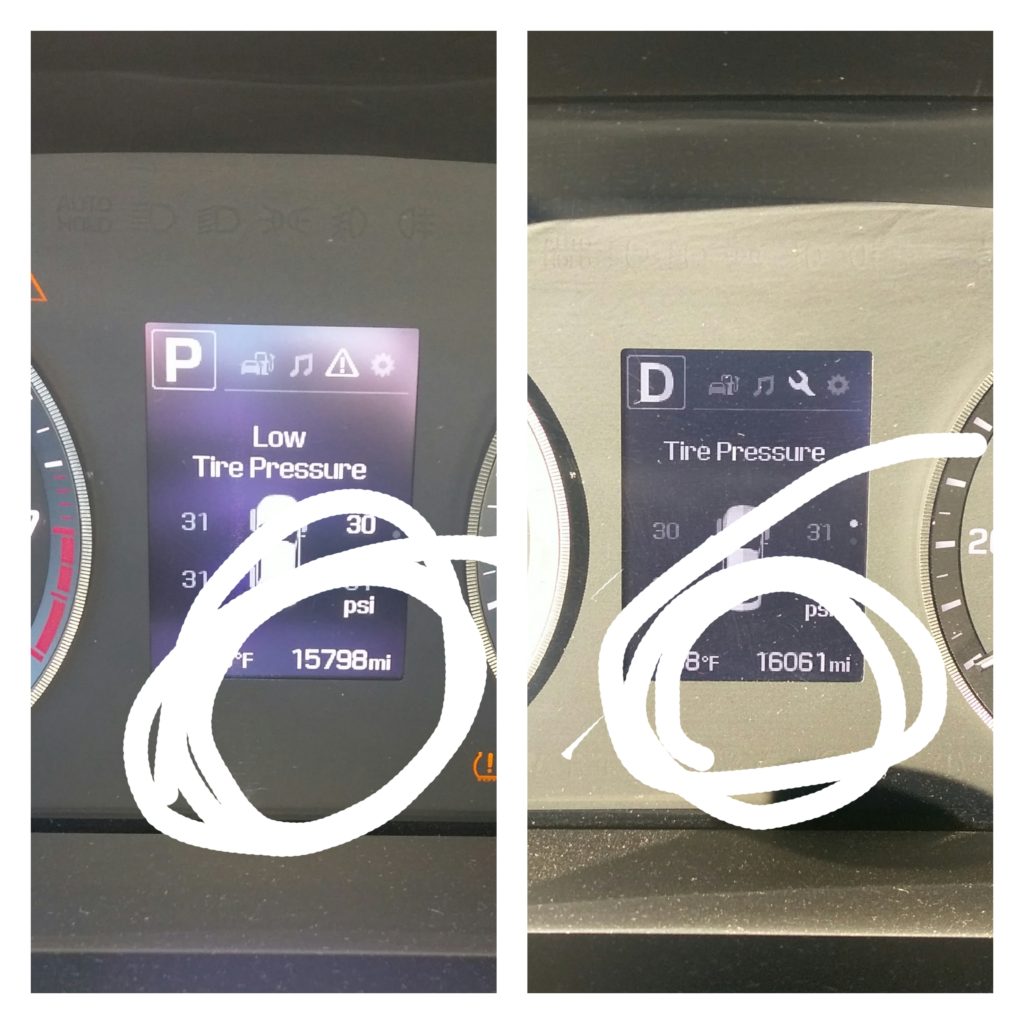

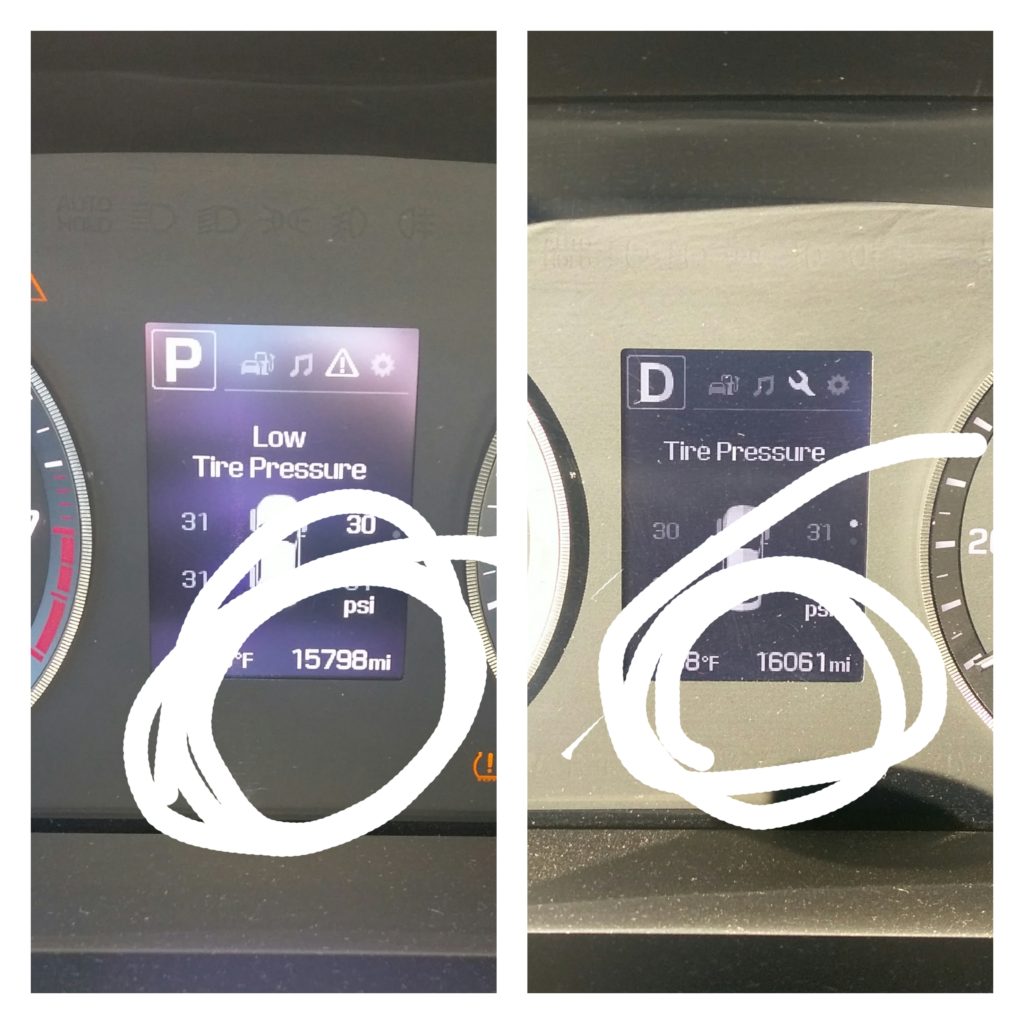

There are two ways of deducting car expenses: standard mileage rate and actual expenses regardless of owning or leasing a car.

Under standard mileage rate you need to multiply amount of miles driven for business purposes by that year mileage rate. This will be you deduction. If you chose standard mileage deduction first year you place car in business, you can change it in the later years to actual expenses, but you cannot go from actual expenses to standard rate. Also If you are leasing a car, and chose to you standard mileage rate, you have to use this method until your lease is up.

Actual expenses is your actual car operating expenses: maintenance and repairs, gasoline and its taxes, oil, insurance, vehicle registration fees, lease payments proportional to the business miles driven vs total miles and depreciation. If you purchased your car, interest portion of your payment is deductible, but only if you are a self -employed. If you are an employee, interest on the car is treated as personal loan and is not deductible even though you might use car 100% for business. In order to claim depreciation, you have to own a car, not lease. If you use your car for both business or investment and personal purposes, you can depreciate only the business or investment use portion.

For 2016, the maximum first-year depreciation write-off for a new (not used) car is $3,160 plus up to an additional $8,000 in bonus depreciation. For a used car, the maximum first-year write-off for 2016 is a much lower $3,160. (These figures assume 100% business use.)

If you have a “luxury” car, chances are that leasing it and using actual expenses will give you more benefit, than using a standard deduction or purchasing it, but always consult a tax professional if you make a decision based on tax benefit, everyone situation is different.

by Viktoriya Khusit | Nov 8, 2016 | Blog |

There are four major driving purposes that taxpayers can deduct miles for:

There are two ways of deducting your car on your tax return, if you use it in connection with your business:

- Taking an actual expenses: car payment, gas, oil change, tolls, parking, etc- this method might be beneficial if you lease a car and don’t drive to much

or

- Take a standard mileage expenses, i.e. multiply amount of miles you drove by standard rate. For 2016 this rate went down from 57.5 cents per mile to .54 cents. This is a business rate, so any time you drive from your office to your clients offices, run business errands, going to meet with clients you need to record miles.

Driving from your personal residence to your office does not considered business miles. Unless your primary place of work is your home and you have qualified home office in your residence, than you can start tracking your miles from your garage.

Even though you might not have a business, here is some miles you can still deduct on your tax return:

Miles you drive to have doctor visits are deductible as well at .19 cents per mile ( down from .23 cents in 2015) and are calculated on schedule A ( Itemized deductions) and subject to 10% AGI (see posts about medical expenses), so if you do not Itemize, don’t waste your time tracking those miles

If you moved for your new job, miles you drove in your car are deductible as well. Rate is the same as for medical purposes and is .19 cent per mile ( see Moving Expenses)

The only rate that did not change from 2015 is rate per miles driven in service of charitable organization and is .14 cents per miles. This expense as well calculated on Schedule A- Itemized deductions.

by Viktoriya Khusit | Nov 3, 2016 | Blog |

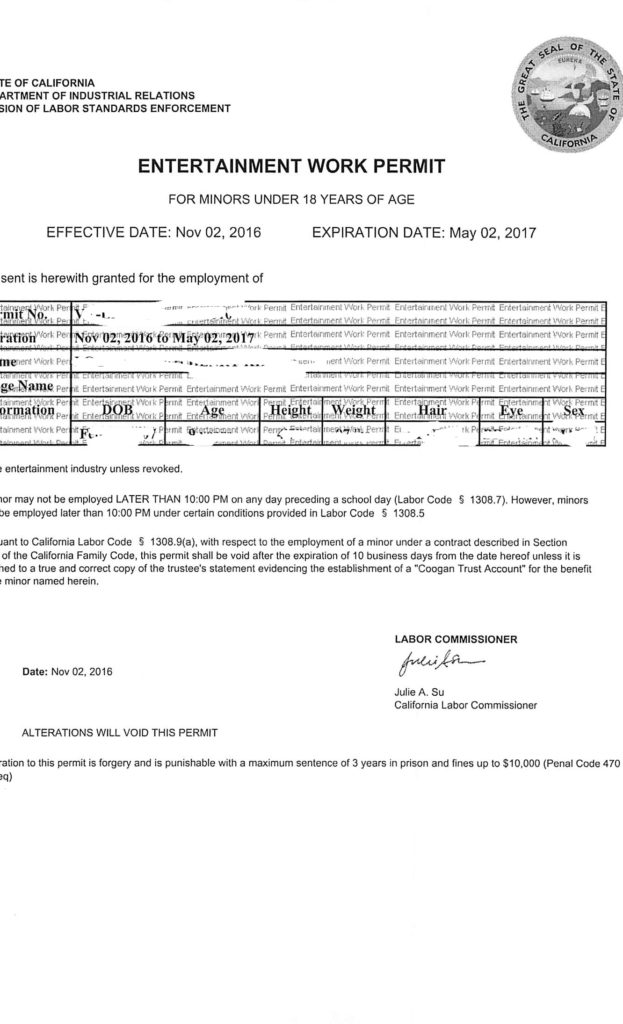

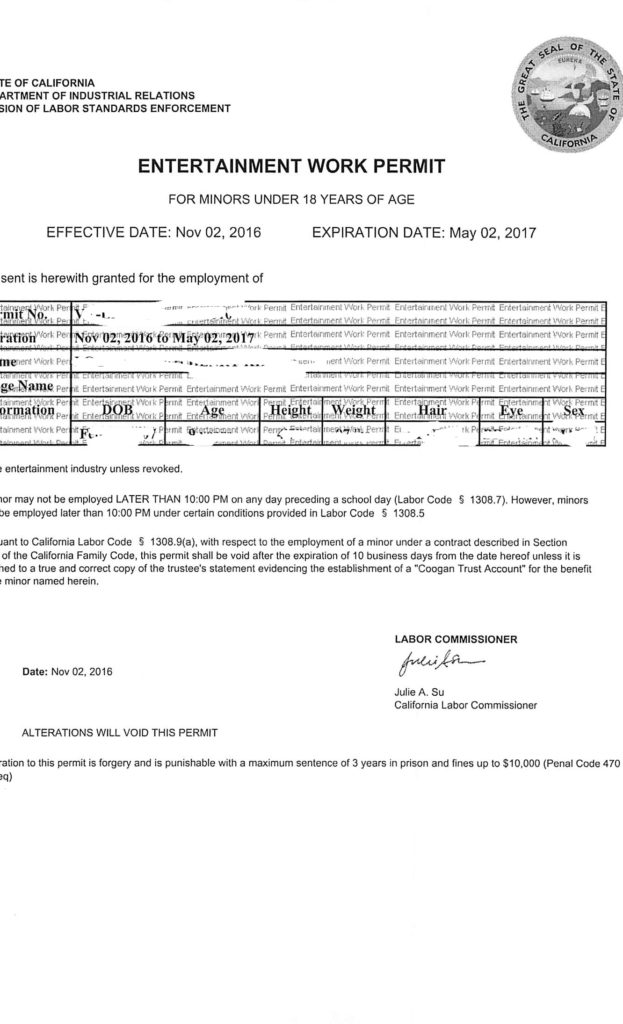

You look at your child, and he/she is the most adorable human being, constantly acting as someone else, or may be really – really wants to be a movie star, so you decide to give it a shot and try to help your child become an actor. What do you do next?

If your child is a minor (under the legal age of full responsibility) you need to apply for entertainment work permit for your child. Click here to see a YouTube video that will show how to apply for 6 month entertainment work permit for your child, how to create an account, what forms you will need if your child of school age. To start you need to create an account, download school and medical forms, that need to be signed by school principal and your child pediatrician. Once you have those forms, you will need to upload them to the account and submit.

If your future star is of school age, you do not need to get a permission from the doctor, despite what the website says, school permission is enough. It might take you several weeks to receive a permit, if you are in a rush you can go directly to the office of Department of Industrial Relationship and get permit on the spot. Time in the office will go faster if you upload everything online before going in. And voila!, your child can work, or actually start submitting for additions. Also, you child will need to get a Coogan account, which is not every bank will open. Two big banks are Wells Fargo and Bank of America. In order to open a bank account you as a guardian will have to bring your child first paycheck or an offer from an employer.

Meanwhile, keep receipts of all the payments you made toward acting, signing, sport classes, miles you drove to take your child to additions, fees for casting websites you paid, payments for head shots and personal coaching for your child, wardrobes purchases ( not the closes child can wear on every day basis, only costumes), as these are all deductible on your tax return. But remember, in order to deduct these expenses, your child needs to actively peruse an acting/modeling/signing career.

by Viktoriya Khusit | Oct 21, 2016 | Blog |

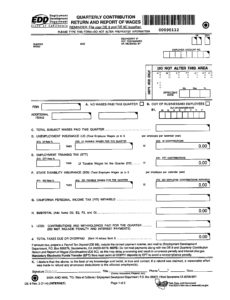

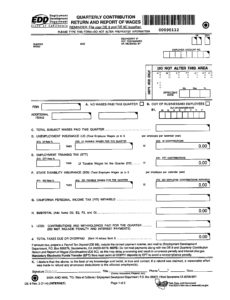

I am in state of California, so we will look at the California State forms.

If you are doing payroll by yourself, remember that you need to fill out 941 Form that you will mail to IRS and two form for Employment Development Department: form DE9 and DE 9C. DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid.

In this Youtube video, I used my company name, also I did not fill out my EDD account number, but you have too.

Also remember that if you are a new employer, Employment Development Department will set your Unemployment Rate (UI) at 3.4% for the first 2 to 3 years. If you purchased an established business, you have the option of acquiring the previous owner’s UI tax rate (see Purchasing a Business With Employees). After that EDD will send you a letter with your UI rate.

The Employment Training Tax (ETT) rate for 2016 is 0.1 %. The UI and ETT taxable wage limit remains at $7,000 per employee per calendar year.

The State Disability Insurance (SDI) withholding rate for 2016 is 0.9 %. The taxable wage limit is $106,742 for each employee per calendar year. The maximum to withhold for each employee is $960.68.

For 2016 you can still fill out forms manually or create an account online under employer services or follow this link and submit all the forms online, as well as make a payment.

However, starting January 1 2017, employers with 10+ employees will be required to file electronically i.e. create online accounts on EDD website, as well as make payment. No more paper coupons!

and

Starting January 1, 2018 every employer will be required to file electronically.

by Viktoriya Khusit | Oct 18, 2016 | Blog |

There are three (3) options to file for married couples.

Most favorable and common is Married Filing Jointly. By filling Married Filing Jointly couple gets higher standard deduction- $12,600 in 2015.

If couple is married, but chooses to file Married Filing Separately, both spouses will have to file separate tax returns to report their own individual income, deductions, credits and exemptions. This way spouses responsible only for their own individual tax liability, and not responsible for any tax liability result from spouse’s tax return. If you chose to file MFS ( Marries Filing Separately), your certain deductions and credits are being limited, such as:

– If one spouse itemizing, the other one has to itemize to or claim “0” as a deduction. ( You cannot chose a standard MFS deduction)

– If both spouses claiming standard deduction, it will be 1/2 of what it would be on a joint tax return -$6,300.00 for 2015

– No Earned Income Credit is allowed

– No Educational tax credit – no America Opportunity or Life Learning credit, no tuition or student loan deductions

– Savers Credit is limited

– Child tax credit is limited

If you live in a community property state, it gets a bit more complicated as you need to report 1/2 of your community income and deductions in addition to your own income and expenses.

There is 3rd option when IRS consider you an “unmarried” because you lived apart from your spouse and meet certain test and can file as Head of Household. This can happened even if couple still legally married and not legally separated.

In any case contact your tax professional, so you can determine what is correct and most advantages filling status for you.