IRS called me. Am I going to jail?

There are a lot of phone calls from someone claiming to be from IRS demanding immediate payment. Its a scam.

There are a lot of phone calls from someone claiming to be from IRS demanding immediate payment. Its a scam. There are a lot of phone calls from someone claiming to be from IRS demanding immediate payment. Its a scam.

There are a lot of phone calls from someone claiming to be from IRS demanding immediate payment. Its a scam.

|

There is a misunderstanding of what Notary certificates when documents are notarized.

Lets break it down and take confusion away.

There are two most common notarial acts that are being performed by a Notary: acknowledgement and Jurat.

Note:Notary cannot tell a signer which form of Notarial act to do. Its illegal. A signer of a document needs to tell a Notary what he/she wants Notary to do.

Lets talk about Acknowledgement.

These are guarantees that Notary provides by motorizing paperwork with acknowledgement:

– signer of a document was physically present during notarization. Face time or Skype sessions are not physical presence

-signer was properly identified by a Notary by using appropriate and allowed forms of identification

-signer acknowledged that he/she signed the document or sign it in front of a Notary

-entire event was recorded in a Notary journal

This might come as a surprise for a lot of people, but signer can sign document anytime and than have it Notarized. With acknowledgement, all signer needs to do is to confirm that he/she signed document to a notary.

Jurat is a document that shows that signer was given an oath and swore that everything in a document he/she signed is true and correct.

|

|

|

Serving alcohol at an open house.

Did you know that even though you as an agent want to serve champagne at your open house, your broker have a right to approve or disapprove this action, so check with your broker before you do it!

But besides approval from your broker, a license is required when open house with alcohol is open to the public and you must have both:

-an on sale license from California department of Alcoholic beverages and Control (The ” ABC”) and

-a type 58 catering permit also issued by the ABC

Here is some challenges of serving an alcohol at an open house even if you obtained both permits:

– Make sure no minors are present

– Whoever is serving alcohol have to require identification from guests ( to make sure that are 21 and older)

– Identify if guests are intoxicated and do not serve alcohol to those guests

– Impose a drink limit on all guests

-Include a variety of alternative, non-alcoholic beverages

If it is a broker open (open house is not open to the public)

You may serve alcohol without a license if these three requirements are met:

civil code 1714 and Business and Professional Code 25602 and 25602.1

Quick Guide- serving Alcohol at an open house

CAR’s Q&A Serving alcohol at an open house

Claiming a minor child

How to split the tax benefits.

Couples get divorce and then there is a question who is claiming a minor child on the tax return. A divorce agreement isn’t enough for the IRS, there is other rules, conditions and forms that need to be fill out.

Tax Benefits of claiming a minor child on a tax return:

Parent with which child resides most of the time is custodial parent, and another one is noncustodial. Usually custodial parent claims all the benefits if eligible, unless he or she signs form 8332 then benefits are getting split between two parents. Custodial parent still able to claim Head of Household Status, Earned income credit and child & dependent care credit (if eligible) and noncustodial parents claims dependency exemption and child tax credit (if eligible).

Parents need to understand that it does not matter if noncustodial parent pays child support or other household expenses for the child; tax law gives priority to the parent who resides with the child for most of the year, and not necessary fully supports the child.

Noncustodial parent needs to receive sign form 8332 from custodial parent and attached it to the tax return, if he or she is claiming tax benefits.

Contact VK Consulting LLC at 818-455-2630 if you need help filing your tax return or any other forms.

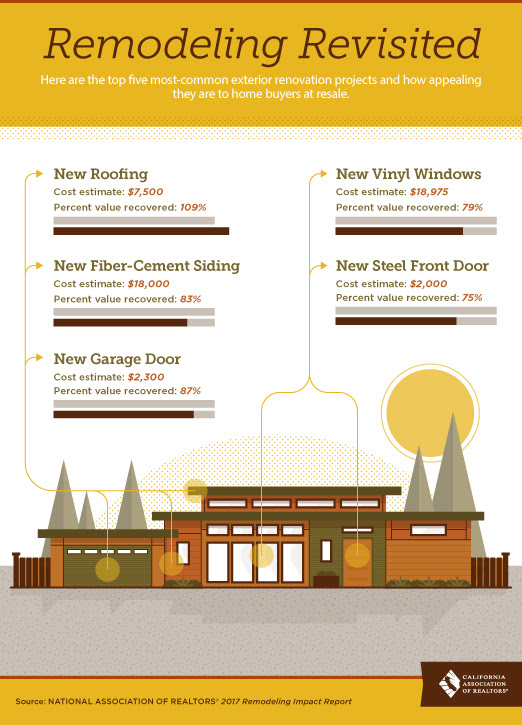

While working on a blog article regarding home improvements that pay, I came across this post on the www.CAR.org (California Association of Realtors), and simply could not not to share. While remodeling does not really increase your selling price, it definitely improves chances of selling faster if house priced at the market average level. However, here is 5 exterior renovation projects that will recover or almost recover money put in into them.