by Viktoriya Khusit | Dec 29, 2016 | Blog |

This is information for all the WPCS (Waiver personal care services)providers who live with the recipient of the services in the same household. IRS ruled that starting March 1, 2016 that IHSS wages received by IHSS (In home supportive services) providers who live in the same household with the person who receives those services are excluded from gross income for the purposes of Federal Income Tax.

Providers have to self certify i.e. complete a live-in self-certification form SOC2298 in order to exclude wages from Federal income tax. This form is available on the CDSS California department of social services website www.cdss.ca.gov starting November 15, 2016.

Remember that until you send in form in, your wages still will be considered income for Federal income taxes. That means that any W2 received prior 2016 and any wages paid in 2017 prior receiving self-certification form will not be amended and will be a part of your gross income for tax purposes.

You need to complete and submit this form only once, and it will work as long as you continue to work for and live with recipient. If you living arrangement change and recipient no longer lives with you, but you continue providing cervices, you need to file form SOC 2299-Live-in self-certification cancellation form. And form SOC 840 Change of address with the IHSS county office.

In situations where you providing services and live in with more than one person, you need to fill out and mail in form for each recipient of your services, for example, if you providing services and living with 2 people, you need to send in two forms.

by Viktoriya Khusit | Dec 9, 2016 | Blog |

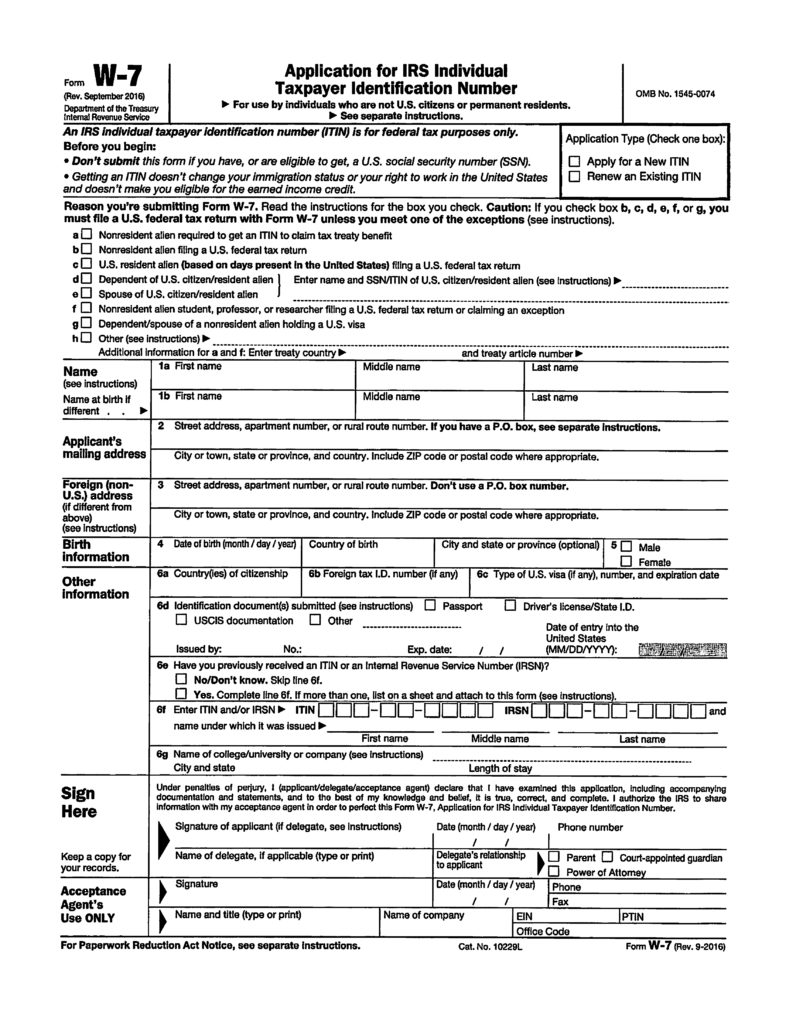

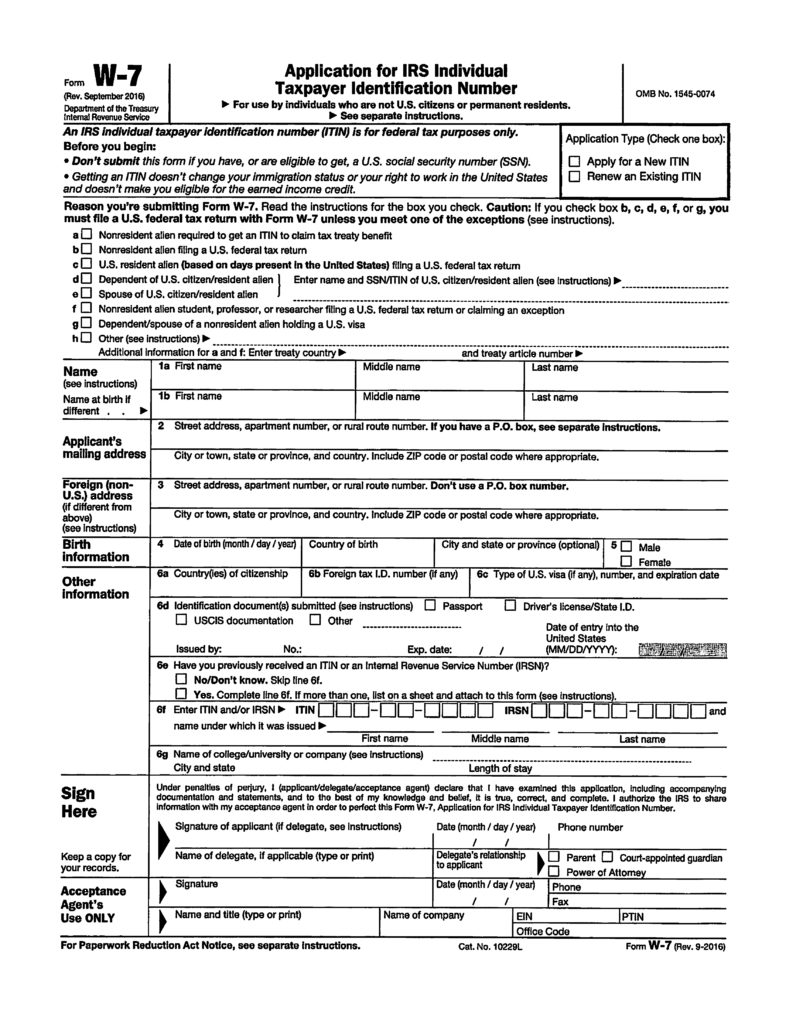

IRS issue ITIN – Individual Taxpayer Identification Number, to all individuals who are required to have US taxpayer identification number, but do not have or not eligible to get a social security number. This is a 9 digit number that starts with 9 and has 7 or 8 as a fourth number. 9NN-7N-NNNN

Here is some people who might need to get an ITIN:

• A nonresident alien required to file a U.S. tax return

• A U.S. resident alien (based on days present in the United States) filing a U.S. tax return

• A dependent or spouse of a U.S. citizen/resident alien

• A dependent or spouse of a nonresident alien visa holder

You cannot:

-work with this number,

-be eligible for Social Security benefits or

-qualify a dependent for Earned Income Tax Credit,

but can:

-file tax return and

-be eligible for Child Tax Credit or

-American Opportunity credit,

where if one spouse has social security number and second does not have any numbers, these credits are not available.

In order to receive ITIN individual need to submit form W7 to IRS

Important update this year: Any ITIN issued prior 2013 are starting to expire starting with ITINs that has middle numbers starting with 78 or 79 (9NN-78-NNNN). Also, if you did not use your ITIN, i,e. did not file a tax return in the past 3 years, starting January 1, 2017 you numbers will no longer be valid on US tax return. IRS started accepting renewals as of October 1, 2016. To renew an expiring ITIN, you must submit a completed Form W-7, Application for IRS Individual Taxpayer Identification Number, and all required identification documents to the IRS. No tax return is required for a renewal application.

Mail the application to Internal Revenue Service, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342.

And as always, contact you tax professional with all your questions!

by Viktoriya Khusit | Nov 30, 2016 | Blog |

Its end of the year and exciting time because of year-end bonuses, but did you know that there are different types of bonuses?

There are two types of bonuses: Non-discretionary and Discretionary.

Non-discretionary is a bonus that announced to employees in advance and usually used to encourage productivity, meet certain deadlines or marks. Starting December 1, 2016 there are new rules for overtime pay which effects non-discretionary bonuses and how they are calculated.

How to Calculate Overtime with a Non-discretionary Bonus:

If the non-discretionary bonus is earned over a single workweek: Add the bonus to the employee’s regular earnings when determining the regular rate of pay for that week.

Example: A non-exempt employee is paid $10 per hour, works 50 hours, and receives a $100 non-discretionary productivity bonus for that week. To calculate overtime:

Step 1: Calculate total straight-time. ($10 hourly rate x 50 hours worked) + $100 bonus = $600

Step 2: Calculate regular rate of pay. $600 straight-time pay divided by 50 hours worked = $12

Step 3: Calculate overtime premium pay. $12 regular rate of pay x .5 x 10 overtime hours = $60

Note: Since the straight-time earnings have already been calculated for all hours worked (see Step 1), the employee is entitled to an additional 10 hours of overtime pay, calculated at one-half the regular rate of pay.

Step 4: Calculate total compensation for week. $60 overtime pay + $600 straight-time pay = $660

Discretionary bonus is not announced in advance, and typically is a surprise to employees.

Regardless of what type of a bonus it is, its taxes at 25% at a federal level ( if the amount of bonus is under $1 million) . Also cash, gift certificates and similar items that can be exchange for cash considered taxable wages regardless of the amount and need to be taxed . However if you get candies or gift basket for holidays those are not considered income.

Happy Holidays!

by Viktoriya Khusit | Nov 15, 2016 | Blog |

There are two ways of deducting car expenses: standard mileage rate and actual expenses regardless of owning or leasing a car.

Under standard mileage rate you need to multiply amount of miles driven for business purposes by that year mileage rate. This will be you deduction. If you chose standard mileage deduction first year you place car in business, you can change it in the later years to actual expenses, but you cannot go from actual expenses to standard rate. Also If you are leasing a car, and chose to you standard mileage rate, you have to use this method until your lease is up.

Actual expenses is your actual car operating expenses: maintenance and repairs, gasoline and its taxes, oil, insurance, vehicle registration fees, lease payments proportional to the business miles driven vs total miles and depreciation. If you purchased your car, interest portion of your payment is deductible, but only if you are a self -employed. If you are an employee, interest on the car is treated as personal loan and is not deductible even though you might use car 100% for business. In order to claim depreciation, you have to own a car, not lease. If you use your car for both business or investment and personal purposes, you can depreciate only the business or investment use portion.

For 2016, the maximum first-year depreciation write-off for a new (not used) car is $3,160 plus up to an additional $8,000 in bonus depreciation. For a used car, the maximum first-year write-off for 2016 is a much lower $3,160. (These figures assume 100% business use.)

If you have a “luxury” car, chances are that leasing it and using actual expenses will give you more benefit, than using a standard deduction or purchasing it, but always consult a tax professional if you make a decision based on tax benefit, everyone situation is different.

by Viktoriya Khusit | Nov 8, 2016 | Blog |

There are four major driving purposes that taxpayers can deduct miles for:

There are two ways of deducting your car on your tax return, if you use it in connection with your business:

- Taking an actual expenses: car payment, gas, oil change, tolls, parking, etc- this method might be beneficial if you lease a car and don’t drive to much

or

- Take a standard mileage expenses, i.e. multiply amount of miles you drove by standard rate. For 2016 this rate went down from 57.5 cents per mile to .54 cents. This is a business rate, so any time you drive from your office to your clients offices, run business errands, going to meet with clients you need to record miles.

Driving from your personal residence to your office does not considered business miles. Unless your primary place of work is your home and you have qualified home office in your residence, than you can start tracking your miles from your garage.

Even though you might not have a business, here is some miles you can still deduct on your tax return:

Miles you drive to have doctor visits are deductible as well at .19 cents per mile ( down from .23 cents in 2015) and are calculated on schedule A ( Itemized deductions) and subject to 10% AGI (see posts about medical expenses), so if you do not Itemize, don’t waste your time tracking those miles

If you moved for your new job, miles you drove in your car are deductible as well. Rate is the same as for medical purposes and is .19 cent per mile ( see Moving Expenses)

The only rate that did not change from 2015 is rate per miles driven in service of charitable organization and is .14 cents per miles. This expense as well calculated on Schedule A- Itemized deductions.

by Viktoriya Khusit | Nov 3, 2016 | Blog |

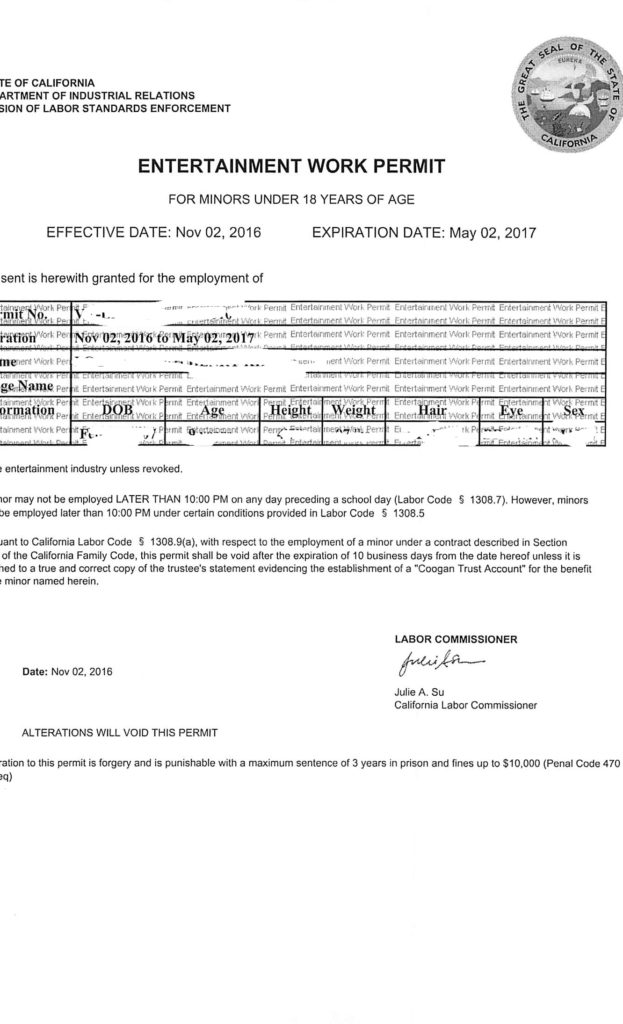

You look at your child, and he/she is the most adorable human being, constantly acting as someone else, or may be really – really wants to be a movie star, so you decide to give it a shot and try to help your child become an actor. What do you do next?

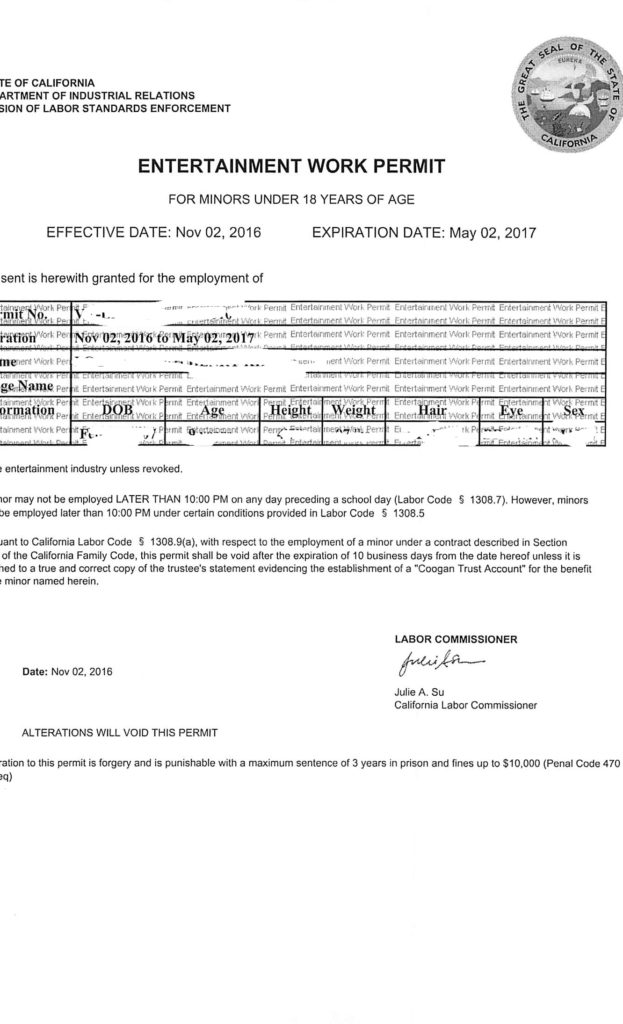

If your child is a minor (under the legal age of full responsibility) you need to apply for entertainment work permit for your child. Click here to see a YouTube video that will show how to apply for 6 month entertainment work permit for your child, how to create an account, what forms you will need if your child of school age. To start you need to create an account, download school and medical forms, that need to be signed by school principal and your child pediatrician. Once you have those forms, you will need to upload them to the account and submit.

If your future star is of school age, you do not need to get a permission from the doctor, despite what the website says, school permission is enough. It might take you several weeks to receive a permit, if you are in a rush you can go directly to the office of Department of Industrial Relationship and get permit on the spot. Time in the office will go faster if you upload everything online before going in. And voila!, your child can work, or actually start submitting for additions. Also, you child will need to get a Coogan account, which is not every bank will open. Two big banks are Wells Fargo and Bank of America. In order to open a bank account you as a guardian will have to bring your child first paycheck or an offer from an employer.

Meanwhile, keep receipts of all the payments you made toward acting, signing, sport classes, miles you drove to take your child to additions, fees for casting websites you paid, payments for head shots and personal coaching for your child, wardrobes purchases ( not the closes child can wear on every day basis, only costumes), as these are all deductible on your tax return. But remember, in order to deduct these expenses, your child needs to actively peruse an acting/modeling/signing career.