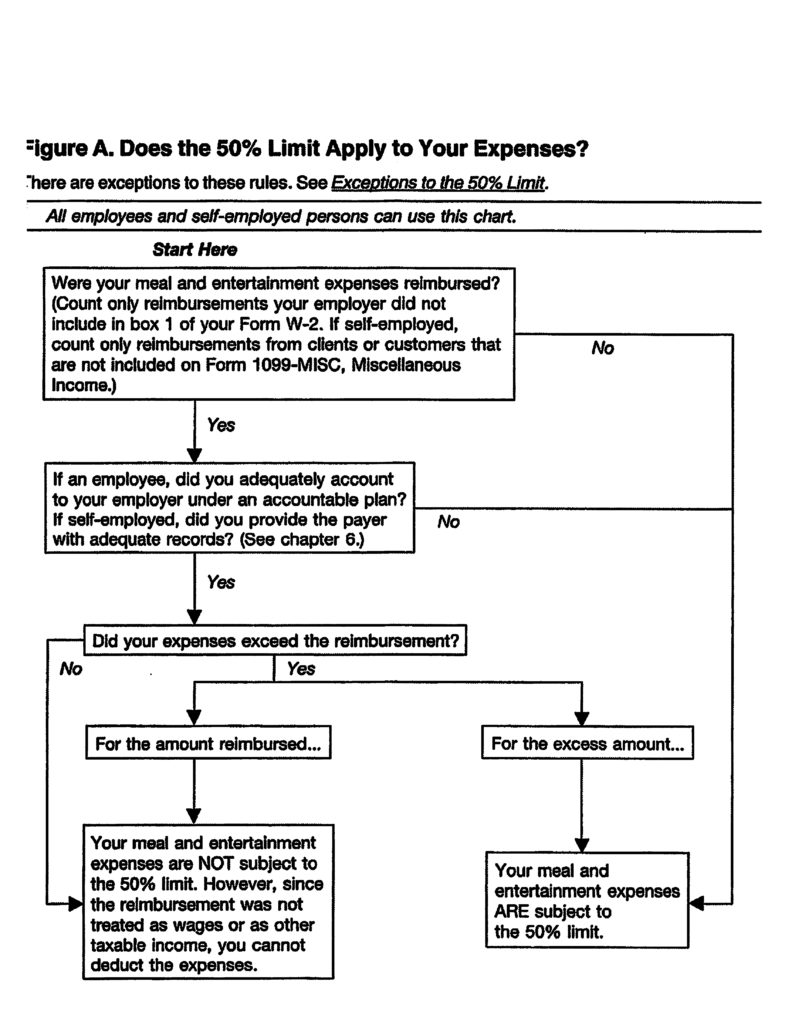

If you had substantial business discussion or went to a convention with a purpose to further your business, you can deduct 50% of your business related meals and entertainment expenses.

However, there are taxpayers who can deduct 80% and some that are not subject to 50% limit at all.

You can deduct 100% if:

* you are distributing food to a general public in order to promote goodwill in the community

or

* you paid for tickets to a qualified charitable sport event, where main purpose of the event was to benefit charitable organization, all the proceeds went to the charity, and the even uses volunteers to perform substantial amount of work.

You can deduct 80% if:

You are air transportation workers under FAA regulations, Interstate truck operators and bus drivers under Department of Transportation regulation, railroad employees under Federal Railroad Administration regulation and merchant marines who are under Coast Guard regulation. These taxpayers can deduct 80% of meal expenses while traveling away from their tax home if the meal falls under Department of Transportation’s “hours of service” limits.

You cannot deduct expenses for entertaining your spouse or a customer’s spouse. However, if you can prove that you had a clear business purpose that led to some sort of business outcome, than you can deduct those expenses at 50%

hi , Im going nuts trying to figure out this horror movie i watched with my brother in the late 70’s early 80’s it was a double feature and 1 of the movies was Piranha , which is why i believe it was in late 70’s as Piranha came out in 78 .. the movie in question is about a haunted house or mansion a group of kids/couples enters said house and the house is like alive and once inside the couples cant get out they try and the house starts to kill them only thing i remember is someone gets out and is on the front lawn and the lawn opens up and swallows him up and in another scene someone is swimming in the pool and like an invisble barrier prevents the swimmer from emerging from the water and he drowns and in the last thing i remember is someone takes a electric saw and trys to cut thru the front door and he saws through his hand ?? if anyone can help me name this movie pls . I was only about 7 yrs old at the time thanks