IRS issue ITIN – Individual Taxpayer Identification Number, to all individuals who are required to have US taxpayer identification number, but do not have or not eligible to get a social security number. This is a 9 digit number that starts with 9 and has 7 or 8 as a fourth number. 9NN-7N-NNNN

Here is some people who might need to get an ITIN:

• A nonresident alien required to file a U.S. tax return

• A U.S. resident alien (based on days present in the United States) filing a U.S. tax return

• A dependent or spouse of a U.S. citizen/resident alien

• A dependent or spouse of a nonresident alien visa holder

You cannot:

-work with this number,

-be eligible for Social Security benefits or

-qualify a dependent for Earned Income Tax Credit,

but can:

-file tax return and

-be eligible for Child Tax Credit or

-American Opportunity credit,

where if one spouse has social security number and second does not have any numbers, these credits are not available.

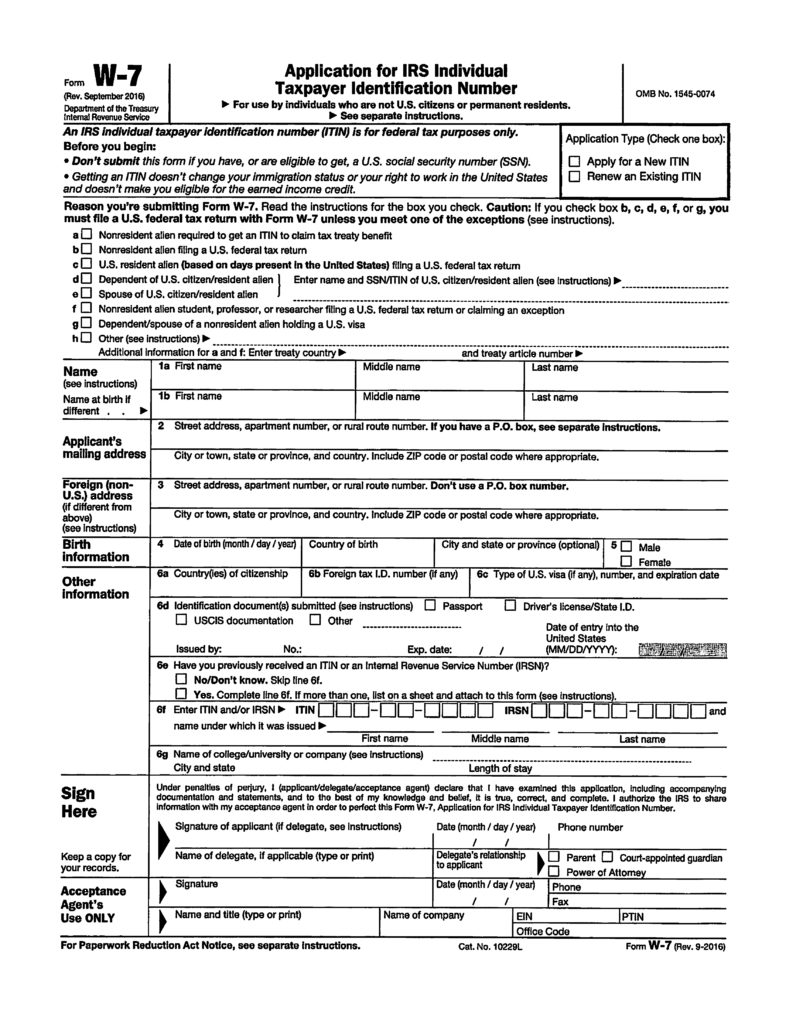

In order to receive ITIN individual need to submit form W7 to IRS

Important update this year: Any ITIN issued prior 2013 are starting to expire starting with ITINs that has middle numbers starting with 78 or 79 (9NN-78-NNNN). Also, if you did not use your ITIN, i,e. did not file a tax return in the past 3 years, starting January 1, 2017 you numbers will no longer be valid on US tax return. IRS started accepting renewals as of October 1, 2016. To renew an expiring ITIN, you must submit a completed Form W-7, Application for IRS Individual Taxpayer Identification Number, and all required identification documents to the IRS. No tax return is required for a renewal application.

Mail the application to Internal Revenue Service, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342.

And as always, contact you tax professional with all your questions!