You have a household employee if:

– you hired someone to do household work

– you can control what work is done

– you can control how work is done

– worker is using your tools and equipment

– hired full time or part time or for the job/project

-you pay by an hour, daily, weekly, or by the job, (how you pay does not matter)

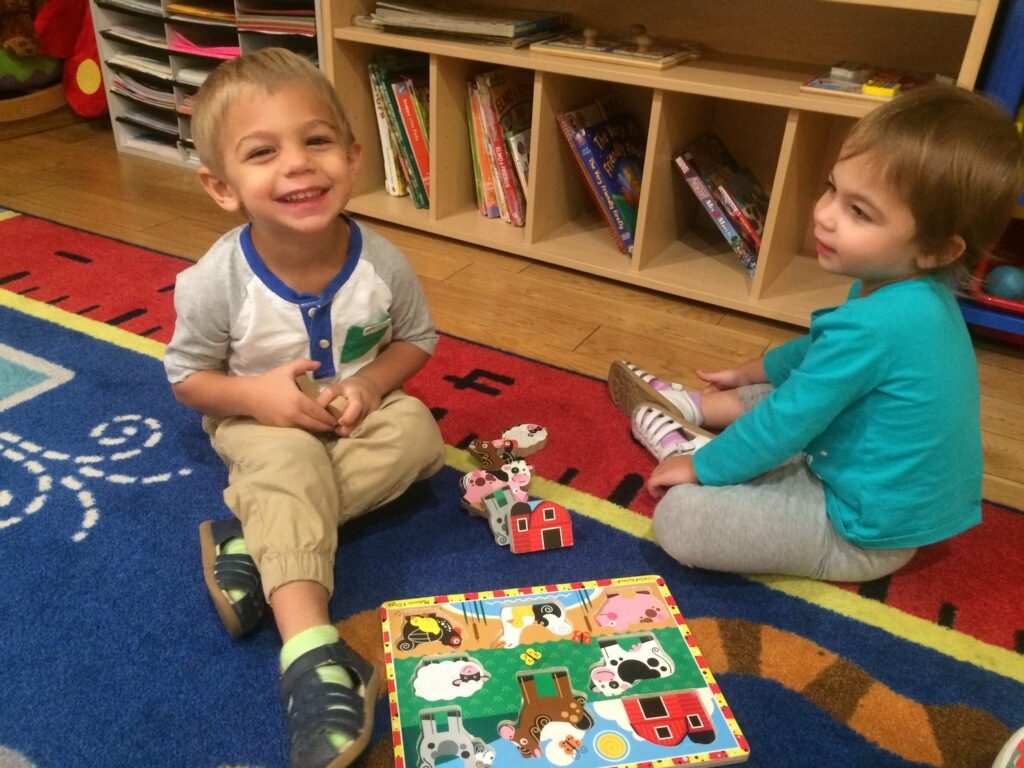

Household work is done in or around your house, and examples of workers are as follow: babysitters, caretakers, cooks, drivers, health aids, house cleaning workers, housekeepers, maids, nannies, private workers and yard workers. However, if your workers runs a business and offers his services to the general public, provides his/her own supplies, tools and equipment, hires help if needed, this person is not your employee.

So you determine that your worker is your employee, what’s next?

- You need to obtain I-9 form, Employment Eligibility Verification from your worker to make sure person is legally authorize to work in the US.

- You need to withhold and pay Social Security and Medicare taxes, pay Unemployment tax. You don’t have to withhold federal income tax , but if your employee asks, you can.

- You also need to get by January 31 of the following year you employed your worker a Employer Identification Number, give your employee W2, file Copy A of W2 and W3 form with the Social Security Administration.

- By April 15 (tax due date) file Schedule H- household employment taxes with your income tax return, and if you don’t have to file you income tax return, than Schedule H by itself with IRS

Don’t forget that each state had different tax rates and you need to check with your state Employment Development Department. Since I am in California, video reflects Schedule H for California state. Click HERE to see Youtube video how to fill out Schedule H for California state.

It looks complicated and overwhelming, but your tax professional can handle this and file a correct way.