by Viktoriya Khusit | Jan 23, 2017 | Blog |

Form 940 Employer’s Annual Federal Unemployment (FUTA) Tax Return is due By January 31. If the fourth quarter FUTA liability, PLUS any deposited FUTA tax from a previous quarter is $500 or less, you can either deposit the tax or pay the tax with your Form 940 filed by January 31. When the deposit due date falls on a Saturday, Sunday, or legal holiday, you may deposit the tax by the next business day.

This video will show how to fill out this form if you pay tax in California ( click on the link)

by Viktoriya Khusit | Jan 11, 2017 | Blog |

You have a household employee if:

– you hired someone to do household work

– you can control what work is done

– you can control how work is done

– worker is using your tools and equipment

– hired full time or part time or for the job/project

-you pay by an hour, daily, weekly, or by the job, (how you pay does not matter)

Household work is done in or around your house, and examples of workers are as follow: babysitters, caretakers, cooks, drivers, health aids, house cleaning workers, housekeepers, maids, nannies, private workers and yard workers. However, if your workers runs a business and offers his services to the general public, provides his/her own supplies, tools and equipment, hires help if needed, this person is not your employee.

So you determine that your worker is your employee, what’s next?

- You need to obtain I-9 form, Employment Eligibility Verification from your worker to make sure person is legally authorize to work in the US.

- You need to withhold and pay Social Security and Medicare taxes, pay Unemployment tax. You don’t have to withhold federal income tax , but if your employee asks, you can.

- You also need to get by January 31 of the following year you employed your worker a Employer Identification Number, give your employee W2, file Copy A of W2 and W3 form with the Social Security Administration.

- By April 15 (tax due date) file Schedule H- household employment taxes with your income tax return, and if you don’t have to file you income tax return, than Schedule H by itself with IRS

Don’t forget that each state had different tax rates and you need to check with your state Employment Development Department. Since I am in California, video reflects Schedule H for California state. Click HERE to see Youtube video how to fill out Schedule H for California state.

It looks complicated and overwhelming, but your tax professional can handle this and file a correct way.

by Viktoriya Khusit | Dec 29, 2016 | Blog |

This is information for all the WPCS (Waiver personal care services)providers who live with the recipient of the services in the same household. IRS ruled that starting March 1, 2016 that IHSS wages received by IHSS (In home supportive services) providers who live in the same household with the person who receives those services are excluded from gross income for the purposes of Federal Income Tax.

Providers have to self certify i.e. complete a live-in self-certification form SOC2298 in order to exclude wages from Federal income tax. This form is available on the CDSS California department of social services website www.cdss.ca.gov starting November 15, 2016.

Remember that until you send in form in, your wages still will be considered income for Federal income taxes. That means that any W2 received prior 2016 and any wages paid in 2017 prior receiving self-certification form will not be amended and will be a part of your gross income for tax purposes.

You need to complete and submit this form only once, and it will work as long as you continue to work for and live with recipient. If you living arrangement change and recipient no longer lives with you, but you continue providing cervices, you need to file form SOC 2299-Live-in self-certification cancellation form. And form SOC 840 Change of address with the IHSS county office.

In situations where you providing services and live in with more than one person, you need to fill out and mail in form for each recipient of your services, for example, if you providing services and living with 2 people, you need to send in two forms.

by Viktoriya Khusit | Dec 9, 2016 | Blog |

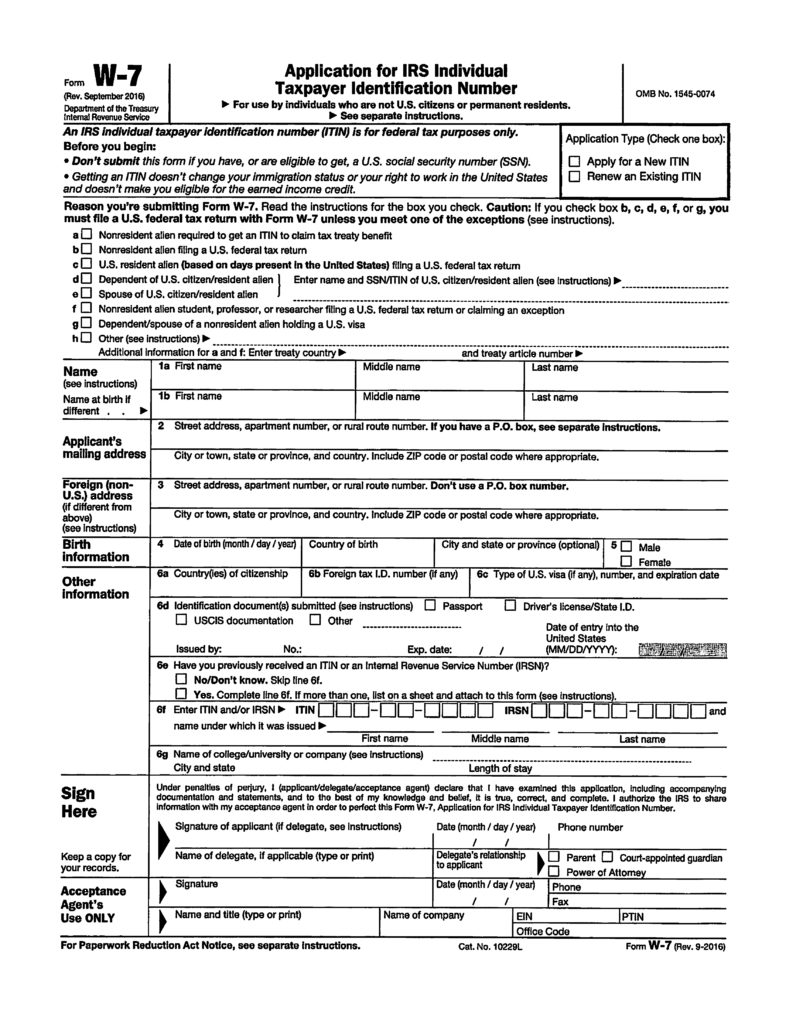

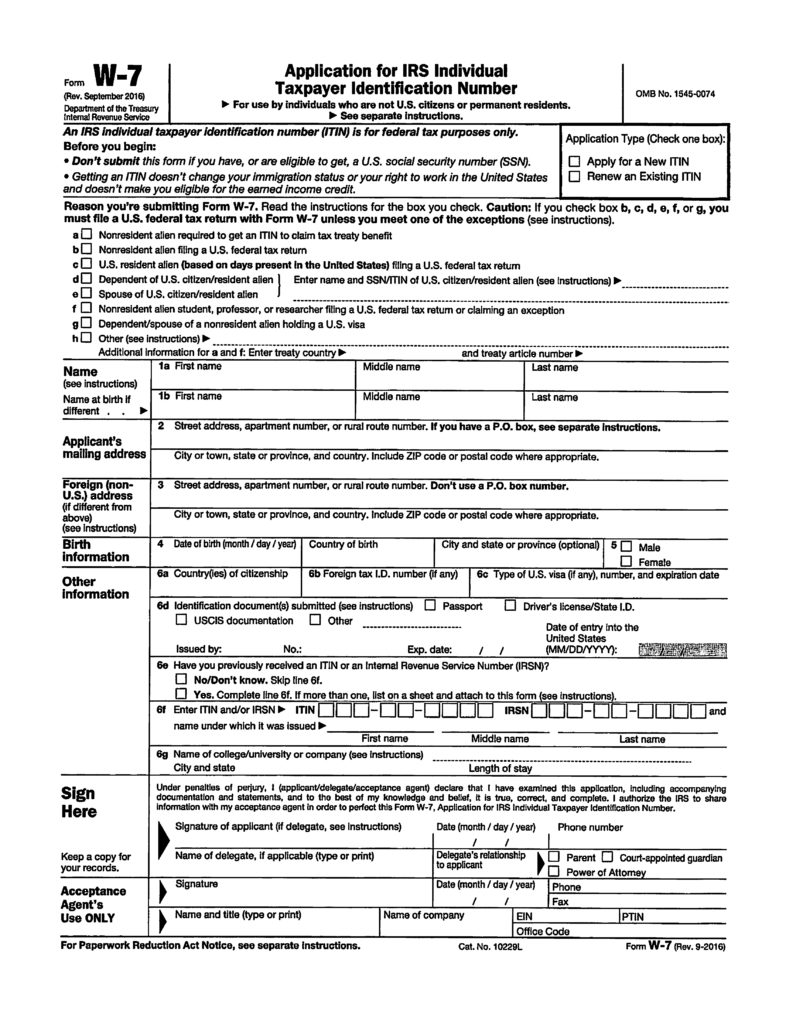

IRS issue ITIN – Individual Taxpayer Identification Number, to all individuals who are required to have US taxpayer identification number, but do not have or not eligible to get a social security number. This is a 9 digit number that starts with 9 and has 7 or 8 as a fourth number. 9NN-7N-NNNN

Here is some people who might need to get an ITIN:

• A nonresident alien required to file a U.S. tax return

• A U.S. resident alien (based on days present in the United States) filing a U.S. tax return

• A dependent or spouse of a U.S. citizen/resident alien

• A dependent or spouse of a nonresident alien visa holder

You cannot:

-work with this number,

-be eligible for Social Security benefits or

-qualify a dependent for Earned Income Tax Credit,

but can:

-file tax return and

-be eligible for Child Tax Credit or

-American Opportunity credit,

where if one spouse has social security number and second does not have any numbers, these credits are not available.

In order to receive ITIN individual need to submit form W7 to IRS

Important update this year: Any ITIN issued prior 2013 are starting to expire starting with ITINs that has middle numbers starting with 78 or 79 (9NN-78-NNNN). Also, if you did not use your ITIN, i,e. did not file a tax return in the past 3 years, starting January 1, 2017 you numbers will no longer be valid on US tax return. IRS started accepting renewals as of October 1, 2016. To renew an expiring ITIN, you must submit a completed Form W-7, Application for IRS Individual Taxpayer Identification Number, and all required identification documents to the IRS. No tax return is required for a renewal application.

Mail the application to Internal Revenue Service, ITIN Operation, P.O. Box 149342, Austin, TX 78714-9342.

And as always, contact you tax professional with all your questions!

by Viktoriya Khusit | Nov 30, 2016 | Blog |

Its end of the year and exciting time because of year-end bonuses, but did you know that there are different types of bonuses?

There are two types of bonuses: Non-discretionary and Discretionary.

Non-discretionary is a bonus that announced to employees in advance and usually used to encourage productivity, meet certain deadlines or marks. Starting December 1, 2016 there are new rules for overtime pay which effects non-discretionary bonuses and how they are calculated.

How to Calculate Overtime with a Non-discretionary Bonus:

If the non-discretionary bonus is earned over a single workweek: Add the bonus to the employee’s regular earnings when determining the regular rate of pay for that week.

Example: A non-exempt employee is paid $10 per hour, works 50 hours, and receives a $100 non-discretionary productivity bonus for that week. To calculate overtime:

Step 1: Calculate total straight-time. ($10 hourly rate x 50 hours worked) + $100 bonus = $600

Step 2: Calculate regular rate of pay. $600 straight-time pay divided by 50 hours worked = $12

Step 3: Calculate overtime premium pay. $12 regular rate of pay x .5 x 10 overtime hours = $60

Note: Since the straight-time earnings have already been calculated for all hours worked (see Step 1), the employee is entitled to an additional 10 hours of overtime pay, calculated at one-half the regular rate of pay.

Step 4: Calculate total compensation for week. $60 overtime pay + $600 straight-time pay = $660

Discretionary bonus is not announced in advance, and typically is a surprise to employees.

Regardless of what type of a bonus it is, its taxes at 25% at a federal level ( if the amount of bonus is under $1 million) . Also cash, gift certificates and similar items that can be exchange for cash considered taxable wages regardless of the amount and need to be taxed . However if you get candies or gift basket for holidays those are not considered income.

Happy Holidays!