Form 941 is an Employer’s Quarterly Federal Tax Return. Employers use this form to report income taxes, social security tax, and Medicare tax withheld from employee’s paychecks, and pay the employer’s portion of social security or Medicare tax.

This form is filled out every quarter and has to be filled with IRS by April 30, July 31, October 31 and January .

If all the deposit for taxes due made timely, than employer has 10 more additional days after January 31 to file 4th quarter employer’s quarterly federal tax return- form 941 Q4.

If you are using payroll provider, it will be done by them. If you use Quickbooks Online and process payroll via Intuit, this form already pre-populated for you. But if you are using a desktop version of accounting software and process payroll manually, click here and use this video as a guide on how to fill 941 Employer’s Quarterly Federal Tax return up. I used my company name in the header just an example.

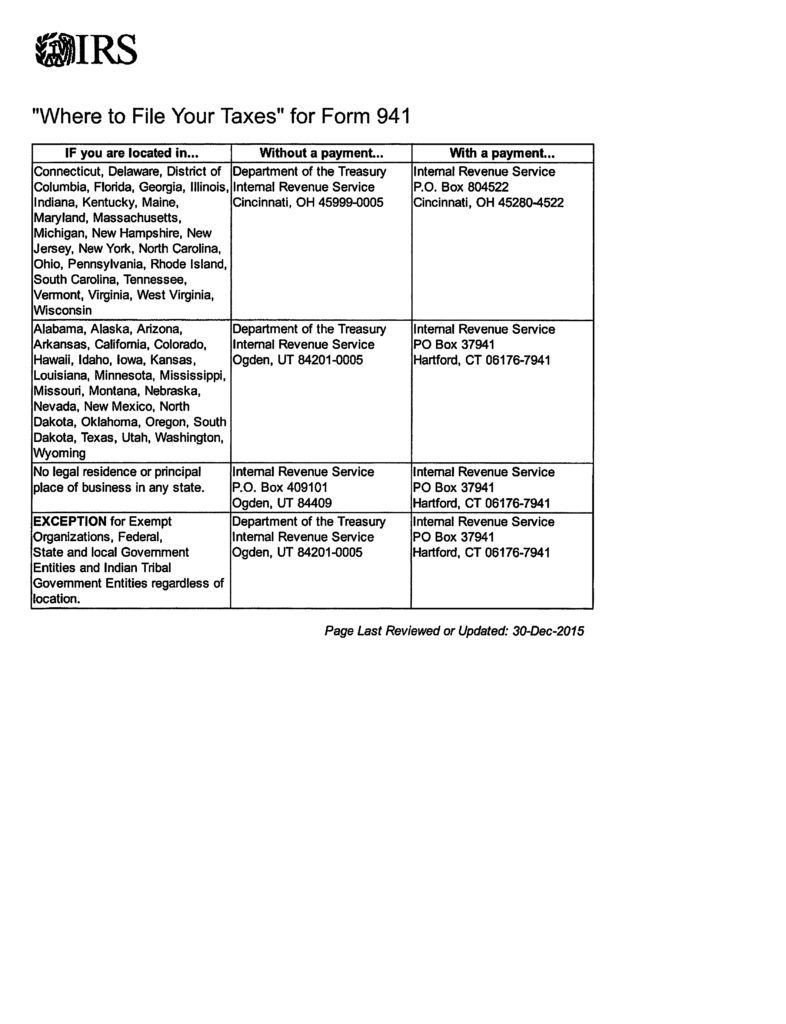

See below where to mail your 941 Employer’s Quarterly Tax return.

Please leave comments and ask questions.