I am in state of California, so we will look at the California State forms.

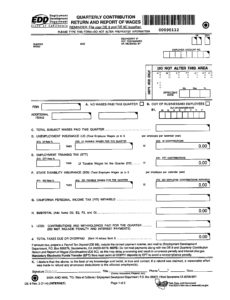

If you are doing payroll by yourself, remember that you need to fill out 941 Form that you will mail to IRS and two form for Employment Development Department: form DE9 and DE 9C. DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid.

In this Youtube video, I used my company name, also I did not fill out my EDD account number, but you have too.

Also remember that if you are a new employer, Employment Development Department will set your Unemployment Rate (UI) at 3.4% for the first 2 to 3 years. If you purchased an established business, you have the option of acquiring the previous owner’s UI tax rate (see Purchasing a Business With Employees). After that EDD will send you a letter with your UI rate.

The Employment Training Tax (ETT) rate for 2016 is 0.1 %. The UI and ETT taxable wage limit remains at $7,000 per employee per calendar year.

The State Disability Insurance (SDI) withholding rate for 2016 is 0.9 %. The taxable wage limit is $106,742 for each employee per calendar year. The maximum to withhold for each employee is $960.68.

For 2016 you can still fill out forms manually or create an account online under employer services or follow this link and submit all the forms online, as well as make a payment.

However, starting January 1 2017, employers with 10+ employees will be required to file electronically i.e. create online accounts on EDD website, as well as make payment. No more paper coupons!

and

Starting January 1, 2018 every employer will be required to file electronically.