by Viktoriya Khusit | Sep 15, 2016 | Blog |

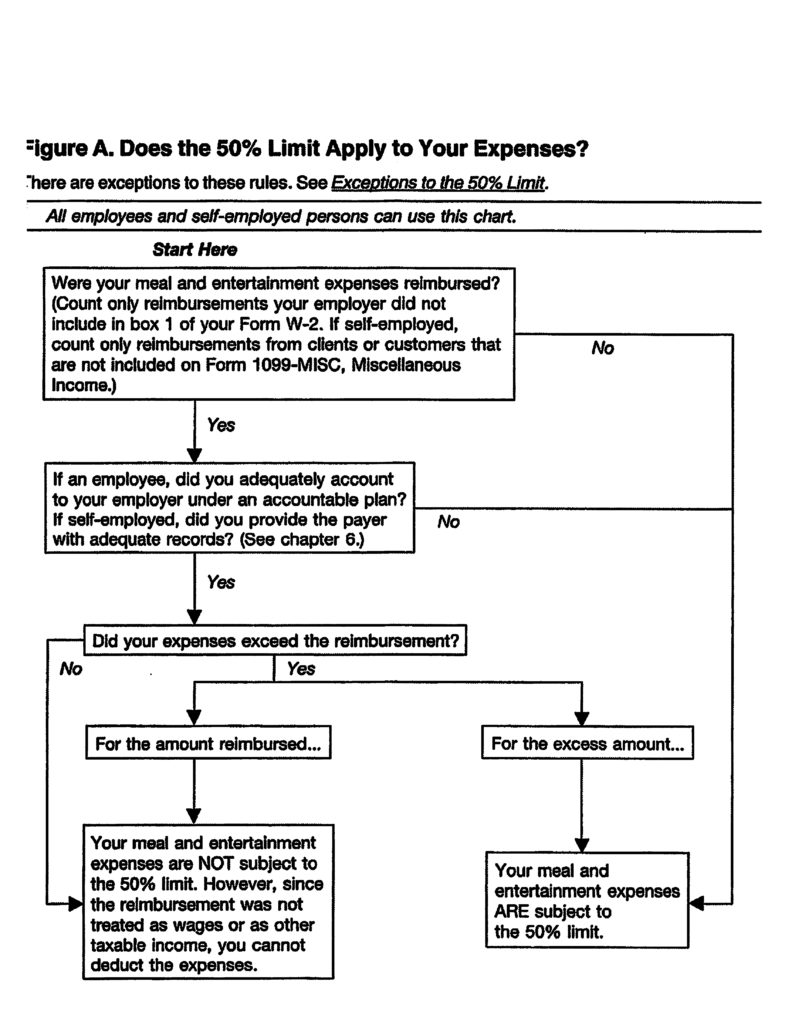

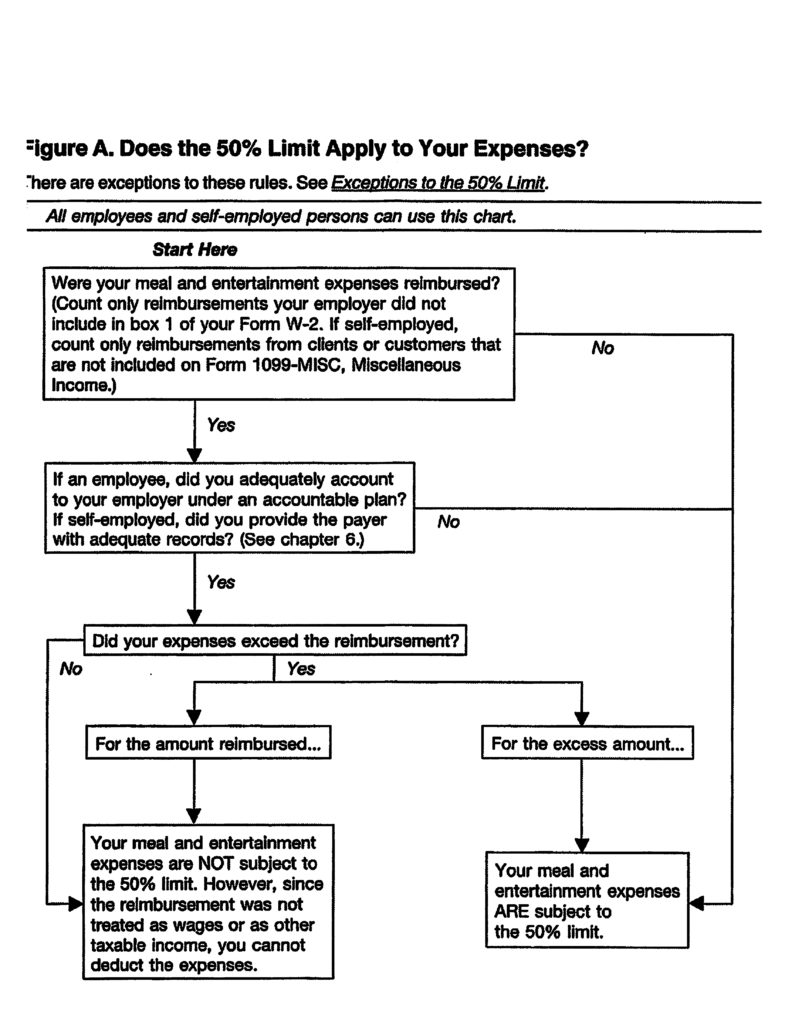

If you had substantial business discussion or went to a convention with a purpose to further your business, you can deduct 50% of your business related meals and entertainment expenses.

However, there are taxpayers who can deduct 80% and some that are not subject to 50% limit at all.

You can deduct 100% if:

* you are distributing food to a general public in order to promote goodwill in the community

or

* you paid for tickets to a qualified charitable sport event, where main purpose of the event was to benefit charitable organization, all the proceeds went to the charity, and the even uses volunteers to perform substantial amount of work.

You can deduct 80% if:

You are air transportation workers under FAA regulations, Interstate truck operators and bus drivers under Department of Transportation regulation, railroad employees under Federal Railroad Administration regulation and merchant marines who are under Coast Guard regulation. These taxpayers can deduct 80% of meal expenses while traveling away from their tax home if the meal falls under Department of Transportation’s “hours of service” limits.

You cannot deduct expenses for entertaining your spouse or a customer’s spouse. However, if you can prove that you had a clear business purpose that led to some sort of business outcome, than you can deduct those expenses at 50%

by Viktoriya Khusit | Sep 14, 2016 | Blog |

Generally, if an item can be considered gift or entertainment, claim it as entertainment.

Packaged food, beverages, flowers, etc you give to a customer to use later, treated as gift expense.

Tickets to the event, that you attended together must be treated as entertainment expense.

However, if you did not go, you have a choice to pick gift or entertainment expense, whichever is more advantageous to you.

When you make your selection remember gift expense is limited to $25 per gift and entertainment expenses deductible at 50%.

Give a call to your tax professional and he or she will be able to help you make a right choice.

by Viktoriya Khusit | Sep 13, 2016 | Blog |

Very often clients come in and want to deduct expenses for gifts they send to their clients, partners or employees. But how much is really deductible?

Rule is that you can deduct $25 per gift you gave a tax year . Meaning if you spent $45 for flowers for the gift to your client, you can deduct only $25 of the price you paid. If you sent flowers four times during a year $40*4=$160, you can deduct $25*4=$100 of your gift expenses.

If you have to pay for delivery of the gift, usually this “incidental cost” does not included into $25 gift expense calculation.

Any item priced at $4 or less and

– have your name on it (such as pen, plastic bags, magnet calendars, desk sets, etc)

or

-signs, display racks and any other promotional items to be used on the recipient premises

ARE NOT considered gifts. (Those are promotional items and will be discussed in another blog post).

by Viktoriya Khusit | Sep 7, 2016 | Blog |

So you are self employed, and use part of your home for business. If you use space regularly and exclusively to conduct business you can deduct certain expenses. Starting 2013 tax year there are two ways of doing it: Simplified option where taxpayer takes $5 per sq foot all inclusive ( up to 300 sq feet) or regular method -calculate a percentage of your rent or mortgage, utilities, insurance devoted to your business use of the home.

Below is a comparison of both methods:

| Simplified Option |

Regular Method |

| Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes |

Same |

| Allowable square footage of home use for business (not to exceed 300 square feet) |

Percentage of home used for business |

| Standard $5 per square foot used to determine home business deduction |

Actual expenses determined and records maintained |

| Home-related itemized deductions claimed in full on Schedule A |

Home-related itemized deductions apportioned between Schedule A and business schedule (Sch. C or Sch. F) |

| No depreciation deduction |

Depreciation deduction for portion of home used for business |

| No recapture of depreciation upon sale of home |

Recapture of depreciation on gain upon sale of home |

| Deduction cannot exceed gross income from business use of home less business expenses |

Same |

| Amount in excess of gross income limitation may not be carried over |

Amount in excess of gross income limitation may be carried over |

| Loss carryover from use of regular method in prior year may not be claimed |

Loss carryover from use of regular method in prior year may be claimed if gross income test is met in current year |

If you owe a home, you should discuss with your tax professional if its beneficial for you to claim a home office deduction vs taking a full mortgage deduction on Schedule A.

by Viktoriya Khusit | Aug 24, 2016 | Blog |

You are a teacher; you constantly buy supplies for your classroom. Can you deduct any of the expenses?

Yes, if you are an eligible educator who is:

- a kindergarten through grade 12:

- Teacher

- Instructor

- Counselor

- Principal, or

- Aide, and

- You work at least 900 hours a school year in a school that provides elementary or secondary education as determined under state law.

Unfortunately starting 2015, a lot of teachers lost educator (teacher) expenses deduction, as it becomes above the line itemized deduction subject to 2% AGI.

For example, your AGI is $30,000, your 2% is 30,000*2%= $600. If you spent less than $600, there is nothing you can deduct, if you spent $850, than you can deduct $250 only . $875-600=$275, but IRS limits you only to $250. $500 if couple filled married filing jointly and both spouses are eligible educators.

So to summarize, before 2015, you could have deducted $250, granted you spent $250 or more.

Starting 2015, you need to spent 2% of your AGI plus $250. This deduction is taken now on Schedule A, Itemized deductions. See a video that shows where it goes.