by Viktoriya Khusit | Oct 21, 2016 | Blog |

I am in state of California, so we will look at the California State forms.

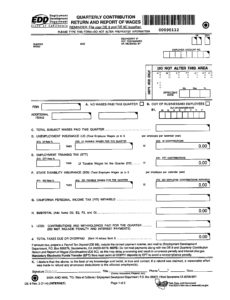

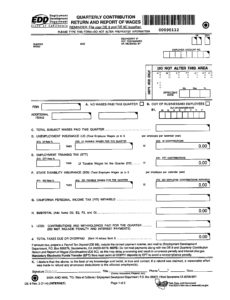

If you are doing payroll by yourself, remember that you need to fill out 941 Form that you will mail to IRS and two form for Employment Development Department: form DE9 and DE 9C. DE9 is to pay taxes and DE 9C is to declare your employees wages and taxes paid.

In this Youtube video, I used my company name, also I did not fill out my EDD account number, but you have too.

Also remember that if you are a new employer, Employment Development Department will set your Unemployment Rate (UI) at 3.4% for the first 2 to 3 years. If you purchased an established business, you have the option of acquiring the previous owner’s UI tax rate (see Purchasing a Business With Employees). After that EDD will send you a letter with your UI rate.

The Employment Training Tax (ETT) rate for 2016 is 0.1 %. The UI and ETT taxable wage limit remains at $7,000 per employee per calendar year.

The State Disability Insurance (SDI) withholding rate for 2016 is 0.9 %. The taxable wage limit is $106,742 for each employee per calendar year. The maximum to withhold for each employee is $960.68.

For 2016 you can still fill out forms manually or create an account online under employer services or follow this link and submit all the forms online, as well as make a payment.

However, starting January 1 2017, employers with 10+ employees will be required to file electronically i.e. create online accounts on EDD website, as well as make payment. No more paper coupons!

and

Starting January 1, 2018 every employer will be required to file electronically.

by Viktoriya Khusit | Oct 18, 2016 | Blog |

There are three (3) options to file for married couples.

Most favorable and common is Married Filing Jointly. By filling Married Filing Jointly couple gets higher standard deduction- $12,600 in 2015.

If couple is married, but chooses to file Married Filing Separately, both spouses will have to file separate tax returns to report their own individual income, deductions, credits and exemptions. This way spouses responsible only for their own individual tax liability, and not responsible for any tax liability result from spouse’s tax return. If you chose to file MFS ( Marries Filing Separately), your certain deductions and credits are being limited, such as:

– If one spouse itemizing, the other one has to itemize to or claim “0” as a deduction. ( You cannot chose a standard MFS deduction)

– If both spouses claiming standard deduction, it will be 1/2 of what it would be on a joint tax return -$6,300.00 for 2015

– No Earned Income Credit is allowed

– No Educational tax credit – no America Opportunity or Life Learning credit, no tuition or student loan deductions

– Savers Credit is limited

– Child tax credit is limited

If you live in a community property state, it gets a bit more complicated as you need to report 1/2 of your community income and deductions in addition to your own income and expenses.

There is 3rd option when IRS consider you an “unmarried” because you lived apart from your spouse and meet certain test and can file as Head of Household. This can happened even if couple still legally married and not legally separated.

In any case contact your tax professional, so you can determine what is correct and most advantages filling status for you.

by Viktoriya Khusit | Oct 13, 2016 | Blog |

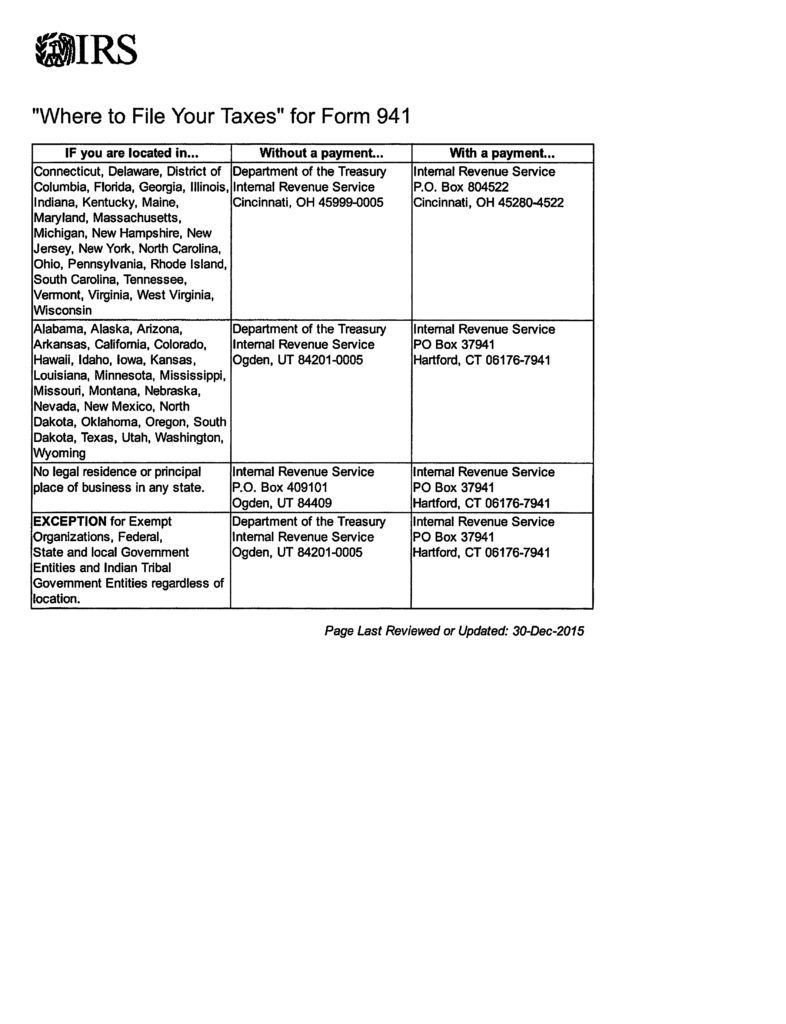

Form 941 is an Employer’s Quarterly Federal Tax Return. Employers use this form to report income taxes, social security tax, and Medicare tax withheld from employee’s paychecks, and pay the employer’s portion of social security or Medicare tax.

This form is filled out every quarter and has to be filled with IRS by April 30, July 31, October 31 and January .

If all the deposit for taxes due made timely, than employer has 10 more additional days after January 31 to file 4th quarter employer’s quarterly federal tax return- form 941 Q4.

If you are using payroll provider, it will be done by them. If you use Quickbooks Online and process payroll via Intuit, this form already pre-populated for you. But if you are using a desktop version of accounting software and process payroll manually, click here and use this video as a guide on how to fill 941 Employer’s Quarterly Federal Tax return up. I used my company name in the header just an example.

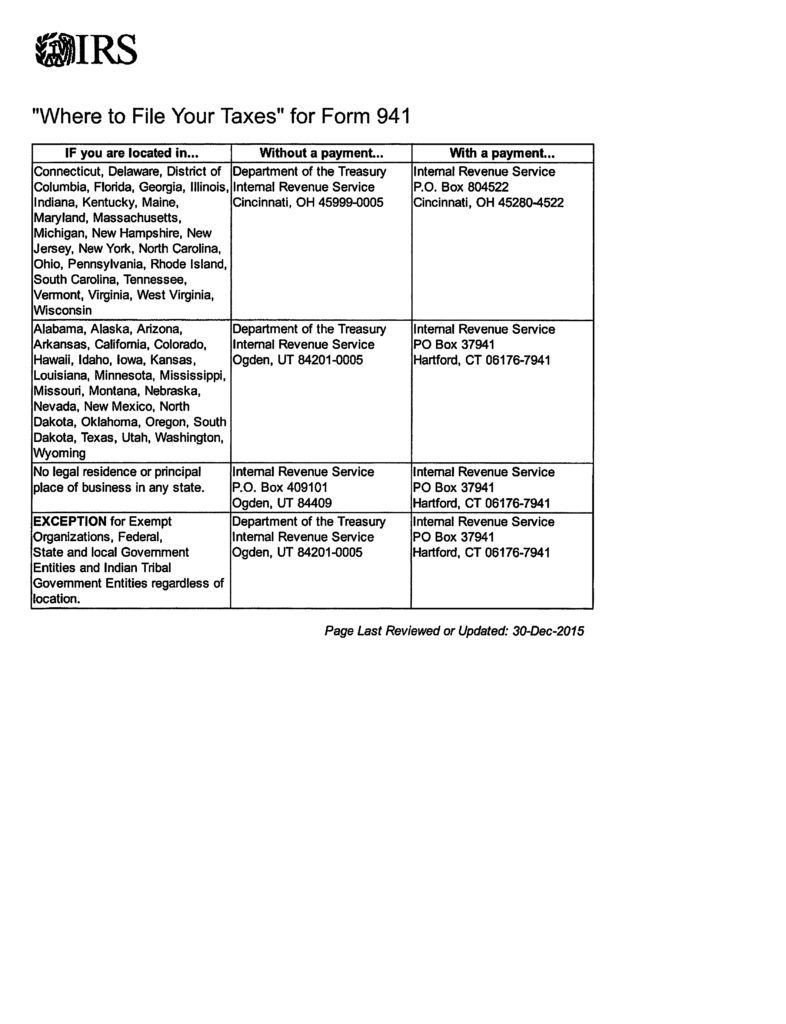

See below where to mail your 941 Employer’s Quarterly Tax return.

Please leave comments and ask questions.

by Viktoriya Khusit | Oct 9, 2016 | Blog |

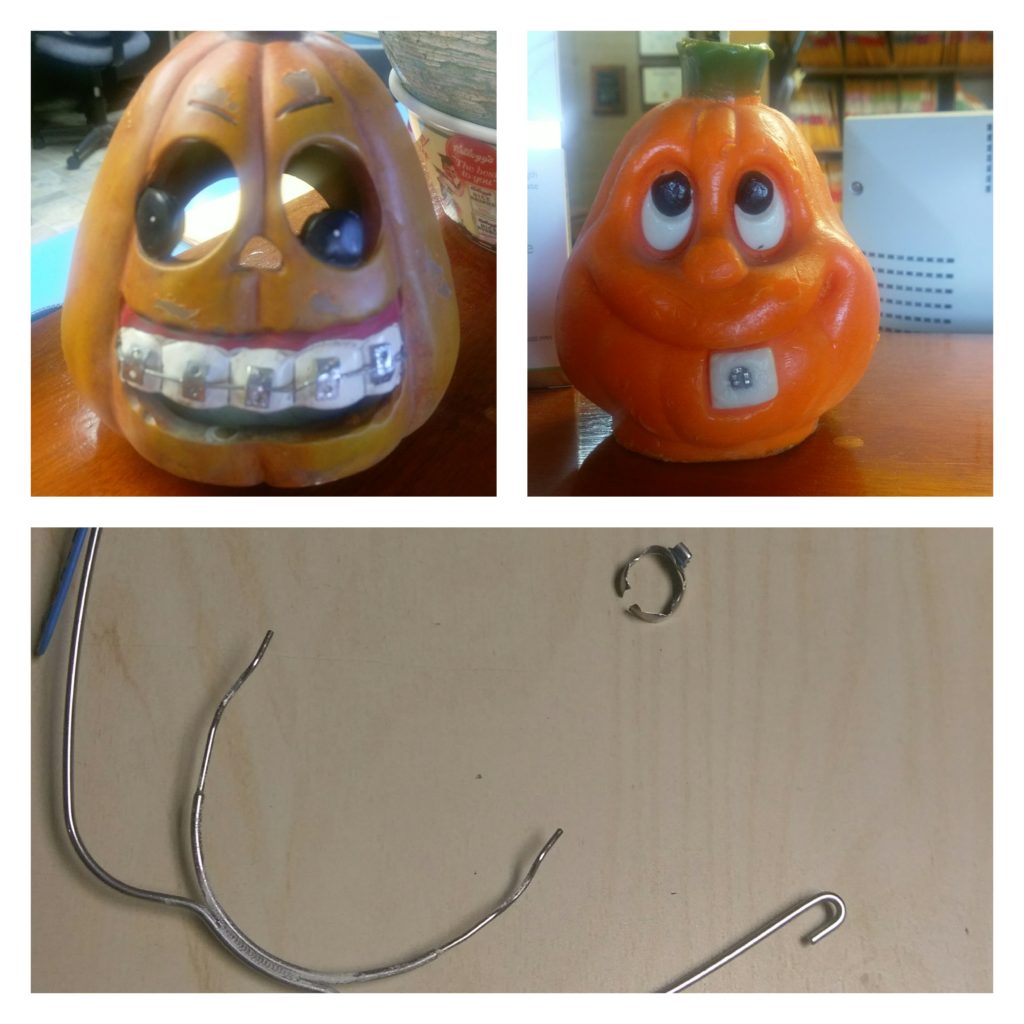

So I am one of those lucky parents whose child needs braces. After shopping around for a while (my insurance doesn’t have ortho coverage) we picked a doctor. Our bill was around $5500.00. In addition during a year we had some prescription medication totaling $300 and dentist visits of $600. Total medical expenses of $6400. A lot of money, right? You would think we would be able to deduct it. For a lot people it’s a wrong assumption

Medical expenses are deductible only when you itemize, meaning you owe property and paying mortgage and real estate taxes, have some sort of donations, and may be have some work dues (not your country club dues). If you itemize then you can calculate how much of your medical expenses is deductible. It’s not 100%. In short you can claim only difference between what you spent on medical expenses and 10% of your AGI. For example, if your family AGI is $55,000.00 your 10% is $5500.00. In my scenario medical expenses were $6400-$5500=$900. Here is a catch: your combine itemized deductions on Schedule A should be more than your standard deduction

Single and Married filling separately $6300,

Married Filling Jointly $12,600,

Head of Household $9250

if you elect to still take itemize deduction that is less than your standard deduction, you will be paying more taxes as your taxable income will be more.

Yes, you might have substantial medical expenses, but it’s not necessarily you can deduct them and if you do not always its better than electing to take a standard deduction.

See how to do it on your tax return HERE.

by Viktoriya Khusit | Sep 27, 2016 | Blog |

Health insurance, health plans and tax-favored arrangements that help to offset health care cost….

Let’s look at Health Saving Plans: how many are there, what do they offer and why would you want to have one.

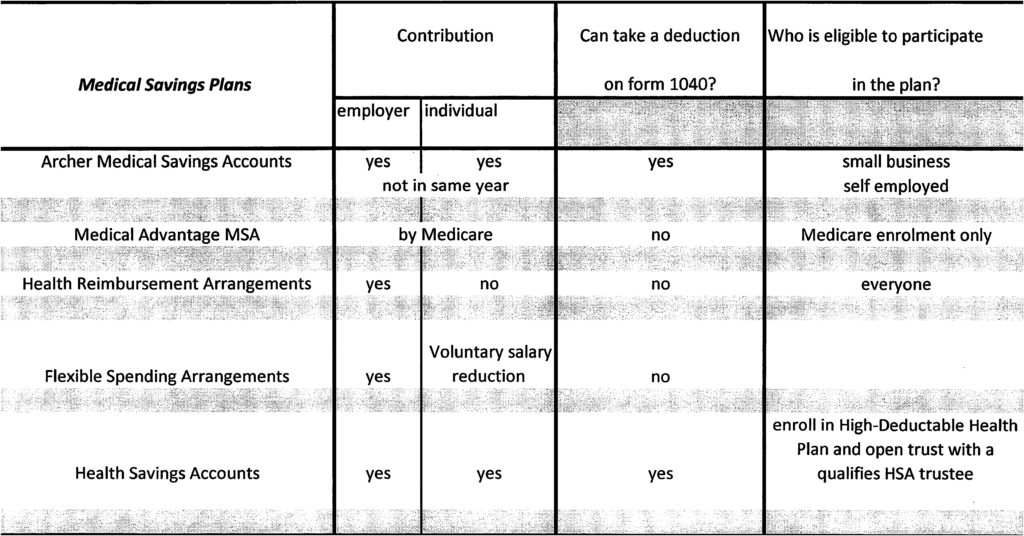

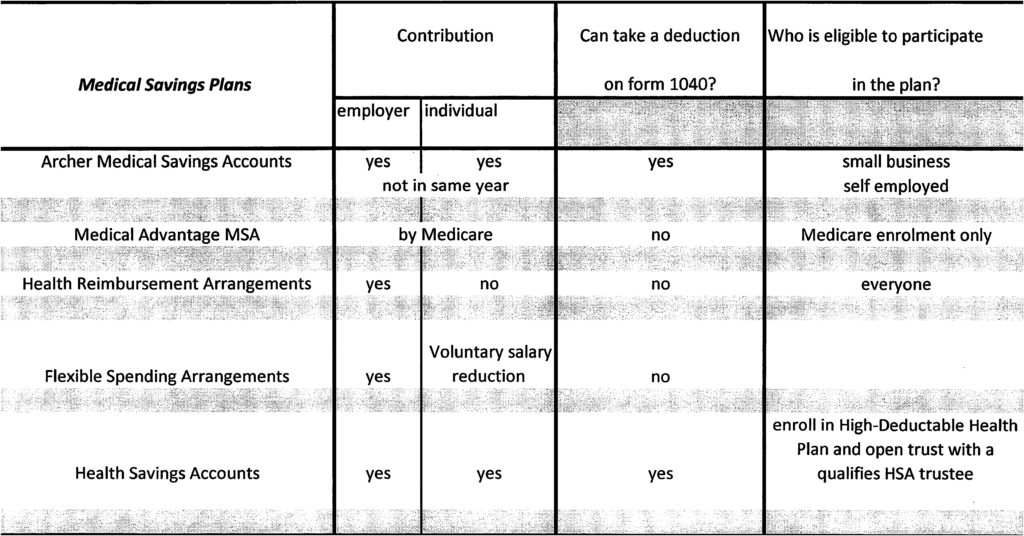

Tax-favored arrangements are:

Archer Medical Savings Accounts (MSA)

Medical Advantage Medical Savings Accounts (MSA)

Health Reimbursement Arrangements (HRA)

Flexible Spending Arrangements (FSA)

Health Saving Accounts (HSA)

Archer MSA is a first generation of HSA. Both employer and employee can contribute to the plan, but not in the same year. Contributions made by employee is deductible on tax return. However, this plan is available only for employees of small employers and self- employed individuals.

Medicare Advantage MSA is an Archer MSA run by Medicare. Account holder has to be enrolled in Medicare and contributions done by Medicare only.

Only employer can contribute to Health Reimbursement Arrangements on behalf of employees.

Flexible Spending Arrangements are funded via a voluntary salary reduction and are considered a reimbursement for medical expenses. It’s not a health plan, but only a way to reimburse for qualified medical expenses.

Health Savings Account (HSA) is a newest medical savings plan. Employee contributions can be used as adjustment to income, contributions can be carried over from year to year until are used. HSA are portable, and they stay with a taxpayer regardless of place of employment. HSA created by enrolling in a high-deductible health plan and opening a tax-exempt trust or custodial account with a qualified HSA trustee (bank, an insurance company or anyone already approved by IRS to be a trustee of IRA or Archer MSA)

by Viktoriya Khusit | Sep 24, 2016 | Blog |

This year one of my clients had to move to a different city because he got a job offer, he could not resist. After excitement from landing a dream job went a way, reality of moving his household settled in. My client, let’s call him John Doe is a single taxpayer without any dependents, so he packed his suitcase, started his car and drove for a couple of days from city A to city B. New employer reimbursed him $300 for the moving expenses. Let’s just pretend transportation of his expenses cost him $100 and hotel $500. Total move was $600, of which $300 was reimbursed by the employer and reported on W2 box 12. Mr. Doe can deduct $300 on line 26 of Form 1040. This is above the line tax deduction, which will make his taxable income $300 less. If there was no reimbursement from employer, the whole moving expense amount is deductible, i.e. $600 in this example; and of course if employer reimburse him in full for the moving expenses, Mr. Doe cannot claim this deduction.

In order to see how much is deductible, one needs to fill out form 3903 (click here to see a short video that shows how to do it) and then transfer final number from form 3903 to line 26 on form 1040.

So, did you move this year? Want to see if you can benefit from this deduction? Follow steps in the video.

But before you even start filing out form 3903 you need to satisfy a few tests:

- Your move need to be close to the start of new job. You move has to be within one year from the date you started your job.

- Distance from your NEW home to a new job has to be NOT longer then from FORMER home to a new job.

- 50 miles rule. If you had 10 miles distance from your old home to your old job, your new job must be 60 miles or more from your old home. If you did not work before, your job needs to be at least 50 miles from your old home.

- Time test. For employees: you have to be employed full time for at least 39 weeks in the 12 months period following start of your new job. For self-employed: 39 week in the first 12 months and for a total of 78 weeks in the first 24 months

And, if you want to claim this deduction, please keep all your receipts. By the way, your meals during move are not deductible.