Health insurance, health plans and tax-favored arrangements that help to offset health care cost….

Let’s look at Health Saving Plans: how many are there, what do they offer and why would you want to have one.

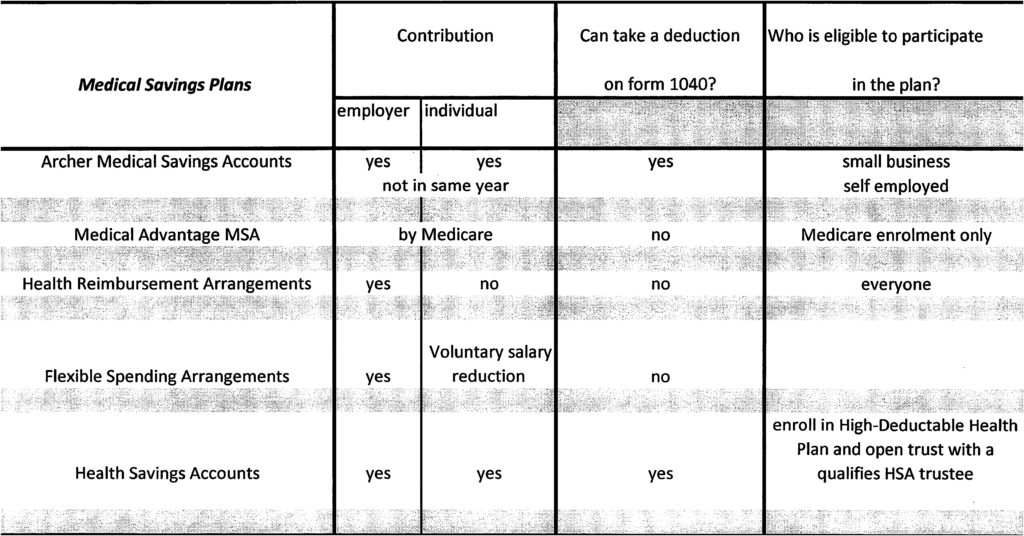

Tax-favored arrangements are:

Archer Medical Savings Accounts (MSA)

Medical Advantage Medical Savings Accounts (MSA)

Health Reimbursement Arrangements (HRA)

Flexible Spending Arrangements (FSA)

Health Saving Accounts (HSA)

Archer MSA is a first generation of HSA. Both employer and employee can contribute to the plan, but not in the same year. Contributions made by employee is deductible on tax return. However, this plan is available only for employees of small employers and self- employed individuals.

Medicare Advantage MSA is an Archer MSA run by Medicare. Account holder has to be enrolled in Medicare and contributions done by Medicare only.

Only employer can contribute to Health Reimbursement Arrangements on behalf of employees.

Flexible Spending Arrangements are funded via a voluntary salary reduction and are considered a reimbursement for medical expenses. It’s not a health plan, but only a way to reimburse for qualified medical expenses.

Health Savings Account (HSA) is a newest medical savings plan. Employee contributions can be used as adjustment to income, contributions can be carried over from year to year until are used. HSA are portable, and they stay with a taxpayer regardless of place of employment. HSA created by enrolling in a high-deductible health plan and opening a tax-exempt trust or custodial account with a qualified HSA trustee (bank, an insurance company or anyone already approved by IRS to be a trustee of IRA or Archer MSA)